Accounting Cryptocurrency Ifrs

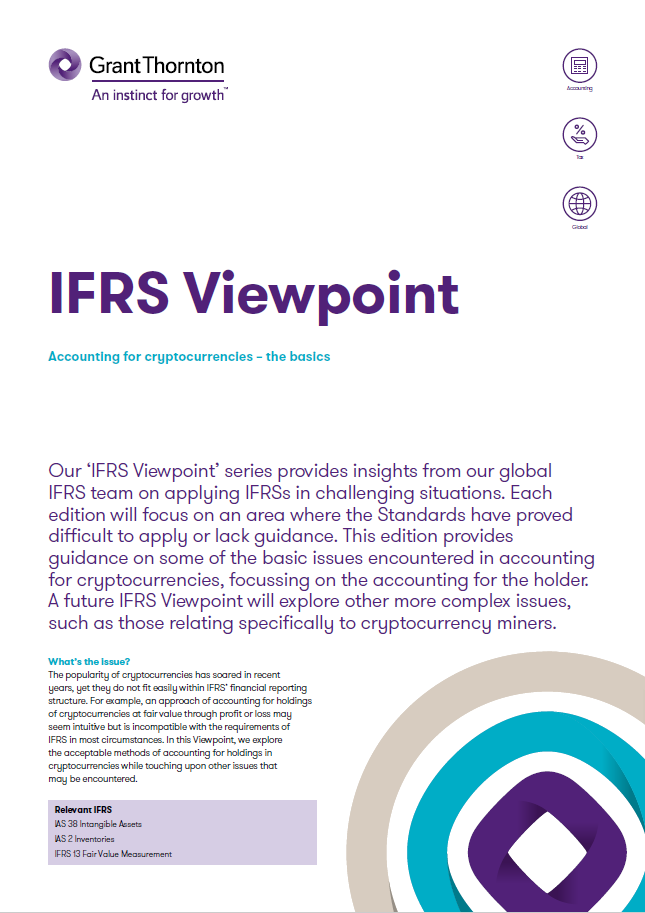

In this Viewpoint we explore the acceptable methods of accounting for holdings in cryptocurrencies. The newly updated version of the PwC publication Cryptographic assets and related transactions.

Arbittmax Cryptocurrency Accounting Gaap

Until recently there was literally nothing official related to accounting for holding of cryptocurrency.

Accounting cryptocurrency ifrs. Crypto-assets are digital assets recorded on a distributed ledger. So accounting for cryptocurrencies is not as simple as it might first appear. Accounting for cryptocurrencies by the holders.

The accounting of cryptocurrency issued is derived by the rights and obligations attached to the cryptocurrency and the guidance of the relevant accounting standards. Categories Other IFRS This report introduces cryptocurrencies and other types of crypto-assets and discusses some recent activities by accounting standard setters in relation to crypto-assets. Crypto-assets experienced a breakout year in 2017.

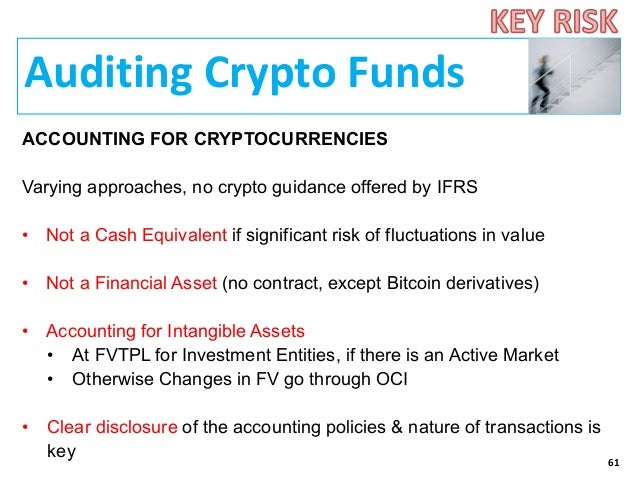

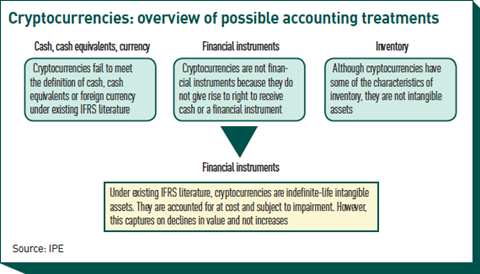

The popularity of cryptocurrencies has soared in recent years yet they do not fit easily within IFRS financial reporting structure. The article also discusses the debatable issues of recognition in the accounting of crypto-currencies. Accounting considerations under IFRS deals with such debates.

The Committee also observed that an entity may act as a broker-trader of cryptocurrencies. This is particularly necessary for cryptographic assets where accounting principles and questions and how IFRS should be applied are still being discussed. Consideration should also be given to the entitys purpose for holding the cryptographic assets to determine the accounting model.

In addition we have compiled a list of resources created by external organizations. These resources were not reviewed developed or approved by. For example an approach of accounting for holdings of cryptocurrencies at fair value through profit or loss may seem intuitive but is incompatible with the requirements of IFRS in most circumstances.

As no IFRS standard currently exists reference must be made to existing accounting standards and perhaps even the Conceptual Framework of Financial Reporting. In many cases they pose a challenge to established beliefs about money economic. If a sole miner concludes that it has income then it will measure.

An introduction to accounting for cryptocurrencies 20 Jun 2018 Chartered Professional Accountants of Canada CPA Canada has published an introduction to. They derive their name from the cryptographic security mechanisms used within public permission-less distributed ledgers. Other crypto assets should be.

In IFRS Viewpoint No9 Accounting for cryptocurrencies the basics we set out our view that holdings of cryptocurrencies are within the scope of IAS 38 Intangible Assets and should generally be accounted for in accordance with that Standard in some circumstances it may be appropriate to account for them using the guidance for broker-traders in IAS 2 Inventories. IFRS does not include specific guidance on the accounting for cryptographic assets and there is no clear industry practice so the accounting for cryptographic assets could fall into a variety of different standards. However its not always clear who the customer is.

In many cases they pose a challenge to established beliefs about money economic. In September 2018 the IFRS Interpretations Committee discussed the application of existing IFRS standards in accounting for cryptocurrencies issued in an ICO. The IFRS Interpretations Committee observed that an entity may hold cryptocurrencies for sale in the ordinary course of business.

However IFRS Interpretations Committee IFRIC met in June 2019 and discussed that and issued their decision so at least we have some official guidance for a part of the problem. Should be noted that there is currently no specific IFRS standard that would disclose these issues. They derive their name from the cryptographic security mechanisms used within public permission-less distributed ledgers.

Accounting for cryptocurrencies under IFRS Introduction to accounting for cryptocurrencies under IFRS Learn about cryptocurrencies and the primary issues involved in accounting for them under International Financial Reporting Standards IFRS. If the cryptocurrency is treated as income then it might be re venue as opposed to other income only if there is an enforceable contract with a customer as required under IFRS 15. 2 presents several IFRS models of accounting treatment for cryptocurrencies either as they reflect the opinions of public authorities on what cryptocurrencies areare not or as suggested by.

This article addresses issues related to recognition evaluation and reflection in accounting cryptocurrency in accordance with IFRS. Crypto-assets are digital assets recorded on a distributed ledger. Introduction to accounting for cryptocurrencies under IFRS May 2018 Accounting for cryptocurrencies under accounting standards for private enterprises ASPE January 2019 External resources.

In that circumstance a holding of cryptocurrency is inventory for the entity and accordingly IAS 2 applies to that holding. 2 IFRS Accounting for crypto-assets What are crypto-assets. 2 IFRS Accounting for crypto-assets What are crypto-assets.

Accounting For Crypto Assets Grant Thornton

Best Intro To Accounting For Cryptocurrencies In 1 View Annual Reporting

Accounting For Cryptocurrencies Under Ifrs Youtube

Arbittmax Cryptocurrency Accounting

Ifrs Update Holding Of Cryptocurrencies Zampa Debattista

Accounting For Crypto Currencies The Ifrs Way

Accounting Models For Ccs Under Ifrs Based On Various Motives Download Scientific Diagram

Pdf Accounting For Bitcoin And Other Cryptocurrencies Under Ifrs A Comparison And Assessment Of Competing Models Semantic Scholar

Https Www Pwc Com Au Assurance Ifrs Assets Cryptographic Assets And Related Transactions Accounting Considerations Under Ifrs Pdf

Https Www Ifrs Org Media Feature Meetings 2019 March Ifric Ap4 Holdings Of Cryptocurrencies Pdf

Pdf Accounting For Bitcoin And Other Cryptocurrencies Under Ifrs A Comparison And Assessment Of Competing Models

Arbittmax Cryptocurrency Accounting

Auditing Funds And Crypto Funds 2018 08 22

Pdf Accounting For Bitcoin And Other Cryptocurrencies Under Ifrs A Comparison And Assessment Of Competing Models Semantic Scholar

Pdf Accounting For Bitcoin And Other Cryptocurrencies Under Ifrs A Comparison And Assessment Of Competing Models

Ifrs Cryptocurrencies Grant Thornton Singapore

Https Www Pwc Com Au Assurance Ifrs Assets Cryptographic Assets And Related Transactions Accounting Considerations Under Ifrs Pdf

Accounting Matters To Virtually Toss A Coin Or Not Features Ipe

Cryptocurrency Accounting A Bookkeeper S Cheat Sheet On Accounting For Crypto Bookstime